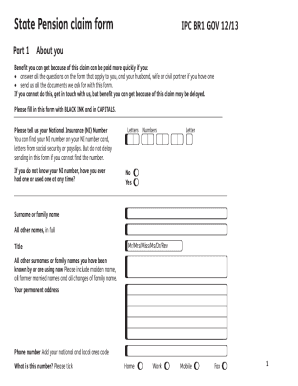

UK IPC BR1 GOV 2009 free printable template

Show details

21-Apr-09 Part 1 About you IPCBR1 01/09 Please tell us your National Insurance (NI) Number You can find your NI number on your NI number card, letters from social security or payslips. But do not

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ca5403 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ca5403 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ca5403 form online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ca5403 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

UK IPC BR1 GOV Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ca5403 form

How to fill out the ca5403 form:

01

Begin by carefully reading the instructions provided with the form. This will ensure that you understand the purpose of the form and the specific information you need to provide.

02

Gather all the necessary documents and information that will be required to complete the form. This may include personal and financial information, supporting documents, and any other relevant paperwork.

03

Start filling out the form by entering your personal information, such as your name, address, and social security number, in the designated fields.

04

Move on to the sections that require you to provide details about your income, deductions, and credits. Be sure to accurately report all relevant information to the best of your knowledge.

05

Use additional pages if needed to provide any additional explanations or details that may be required for certain sections of the form.

06

Double-check all the information you have entered before submitting the form. Make sure there are no errors or missing details that could potentially cause delays or complications.

Who needs the ca5403 form:

01

Individuals who need to report specific financial information related to their taxes may need to fill out the ca5403 form. It is typically used for certain tax purposes or situations that require the reporting of additional information beyond the standard tax forms.

02

The specific need for the ca5403 form may vary depending on the individual's circumstances, such as claiming certain tax credits or deductions, reporting foreign income, or addressing specific tax-related issues.

03

It is advisable to consult a tax professional or the official guidelines provided by the tax authorities to determine if you need to fill out the ca5403 form in your particular situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ca5403 form?

The form CA5403 refers to the California Nonresident or Part-Year Resident Income Tax Return. This form is used by individuals who are nonresidents or part-year residents of California to report their income earned in the state and calculate their tax liability. It is separate from the regular California Resident Income Tax Return (Form 540).

Who is required to file ca5403 form?

The CA5403 form is not a requirement for filing taxes. It is a form used in the state of California for taxpayers to request relief from various penalties imposed by the Franchise Tax Board. Individuals who believe they have reasonable cause may submit this form to request penalty abatement.

How to fill out ca5403 form?

To fill out the CA5403 form, follow these steps:

1. Begin by providing your personal information in Section A. This includes your full name, Social Security Number, and contact details.

2. In Section B, indicate the tax year for which you are applying for relief.

3. Next, move to Section C and provide information about your spouse if applicable. Include their name, Social Security Number, and contact details.

4. In Section D, provide details about your marital status. Check the appropriate box that indicates if you are separated, divorced, or legally married but living separately.

5. If you are applying for relief under innocent spouse/relief from liability, proceed to Section E. Here, you will need to provide information about the tax return(s) that you seek relief from, including the tax years and any applicable adjustments or credits.

6. In Section F, indicate the basis for your claim by checking the appropriate box that applies to your situation. The options include erroneous item, separated liability, and community property law.

7. If you are requesting innocent spouse relief, complete Section G by providing information about your knowledge or lack of knowledge regarding the understated tax liabilities.

8. In Section H, specify the reason(s) why you believe you qualify for relief from joint and several liability.

9. Attach any supporting documentation that backs up your claim, such as correspondence with the IRS, documents related to your spouse's income or expenses, or legal agreements.

10. Review the entire form for accuracy and completeness before signing and dating it.

11. Finally, mail the completed form and all supporting documents to the appropriate address listed in the form's instructions, usually an IRS office. Make copies of everything for your records.

Remember, it is always advisable to consult with a tax professional or the IRS for specific guidance on completing the CA5403 form in your unique situation.

What is the purpose of ca5403 form?

The CA5403 form, also known as the California Adjustments - Resident and Nonresident worksheet, is used for calculating California-specific adjustments to federal taxable income. It is required for individuals who are California residents and file their state income tax return, as well as for nonresidents who have any income derived from California sources.

The purpose of the CA5403 form is to determine the appropriate adjustments to be made to the federal taxable income to arrive at the California taxable income. It includes various calculations and adjustments for items such as income and deductions that are treated differently by the state of California compared to the federal tax regulations. These adjustments are necessary to accurately report and calculate the amount of tax owed to the state of California.

What information must be reported on ca5403 form?

The CA5403 form, also known as the California Use Tax Worksheet, is used to report and calculate the use tax owed on purchases made from out-of-state retailers that did not collect California sales tax.

The following information must be reported on form CA5403:

1. Purchaser's information: Name, Social Security Number, and Address.

2. Description of the property or items purchased.

3. Date and location of purchase.

4. Cost of the purchases.

5. Amount of sales tax paid, if any.

6. Total of the purchases subject to California use tax.

7. Calculation of use tax owed based on the total taxable purchases.

8. Any applicable credits or payments made towards the use tax amount owed.

9. The final amount of use tax owed or overpaid.

It is important to note that the CA5403 form is filed and submitted along with the individual's California state income tax return, specifically for reporting and paying any use tax owed.

What is the penalty for the late filing of ca5403 form?

The penalty for the late filing of form CA5403, which is a request for a penalty waiver, may vary depending on the specific circumstances and the discretion of the tax authorities. However, generally, late filing penalties can range from a minimum of $50 to a maximum of $135 or more, depending on the amount and duration of the delay. It is best to consult the California Franchise Tax Board (FTB) or a tax professional for the most accurate and up-to-date information regarding penalties for late filing of form CA5403.

How do I modify my ca5403 form in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign ca5403 form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete ca5403 form online?

Filling out and eSigning ca5403 form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit ca5403 form on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign ca5403 form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your ca5403 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.