UK IPC BR1 GOV 2009 free printable template

Show details

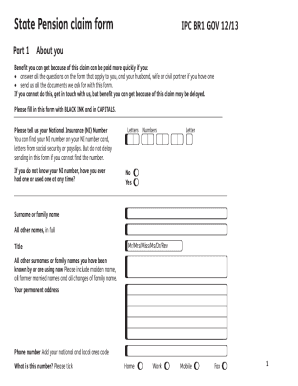

21-Apr-09 Part 1 About you IPCBR1 01/09 Please tell us your National Insurance (NI) Number You can find your NI number on your NI number card, letters from social security or payslips. But do not

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK IPC BR1 GOV

Edit your UK IPC BR1 GOV form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK IPC BR1 GOV form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK IPC BR1 GOV online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UK IPC BR1 GOV. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK IPC BR1 GOV Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK IPC BR1 GOV

How to fill out UK IPC BR1 GOV

01

Start by gathering the necessary information about your business, including its name, registered address, and contact details.

02

Identify the type of business entity you are registering (e.g., sole trader, partnership, limited company).

03

Fill out the UK IPC BR1 form with accurate and complete information, paying attention to sections related to directors, shareholders, and the nature of the business.

04

Provide supporting documents as required, such as identification for directors and proof of address.

05

Review the completed form for any errors or omissions.

06

Submit the form along with the appropriate fee to Companies House, either online or by mail.

Who needs UK IPC BR1 GOV?

01

Any individual or group looking to establish a new business in the UK.

02

Existing businesses that need to update their incorporation details or make changes.

03

New partnerships or limited companies registering for the first time.

Fill

form

: Try Risk Free

People Also Ask about

Can I transfer my pension to another country?

It's also possible that transferring it will change the amount you receive when you retire, but you'll need to check this with your provider. Moving your pension to another country can be quite complex, so it's best to speak to a regulated financial adviser before you do anything.

How do I claim my UK pension from the US?

To claim your pension, you can either: contact the International Pension Centre. send the international claim form to the International Pension Centre (the address is on the form)

Can a non UK resident pay into a UK pension?

Yes, this is possible although what can be paid depends on who wants to make contributions and whether a member's earnings will be subject to UK income tax on moving abroad. Personal contributions to an occupational pension scheme are made under the 'net pay arrangement'.

Can a US citizen contribute to a UK pension?

Thanks to the U.S./U.K. tax treaty, U.S. citizens with U.K. pensions can deduct contributions from income to their U.K. pension just like they could for an American 401(k) or similar retirement vehicles.

Can non residents contribute to a UK pension?

Yes, this is possible although what can be paid depends on who wants to make contributions and whether a member's earnings will be subject to UK income tax on moving abroad. Personal contributions to an occupational pension scheme are made under the 'net pay arrangement'.

What is the international pension direct payment?

What is International Pensions Direct Payment? International Pensions Direct Payment is the Department for Work and Pensions' way of paying your pension or benefit direct to an account of your choice outside the United Kingdom.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my UK IPC BR1 GOV in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign UK IPC BR1 GOV and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete UK IPC BR1 GOV online?

Filling out and eSigning UK IPC BR1 GOV is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit UK IPC BR1 GOV on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign UK IPC BR1 GOV right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is UK IPC BR1 GOV?

UK IPC BR1 GOV is a form used to report information related to the income and corporation tax activities of certain businesses in the UK. It is part of the HM Revenue & Customs (HMRC) requirements for businesses operating in the country.

Who is required to file UK IPC BR1 GOV?

Businesses that are registered for corporation tax in the UK, including limited companies and certain organizations, are required to file UK IPC BR1 GOV.

How to fill out UK IPC BR1 GOV?

To fill out UK IPC BR1 GOV, businesses must provide accurate financial information as prescribed in the form, including income details, expenses, and other tax-relevant information. It is advised to consult HMRC guidelines or a tax professional when completing the form.

What is the purpose of UK IPC BR1 GOV?

The purpose of UK IPC BR1 GOV is to gather important financial information from businesses, which aids the HMRC in assessing tax liabilities and ensuring compliance with tax regulations.

What information must be reported on UK IPC BR1 GOV?

UK IPC BR1 GOV requires businesses to report various financial details, including total income, allowable expenses, tax reliefs, and any relevant deductions. Specific sections of the form will detail what information is necessary.

Fill out your UK IPC BR1 GOV online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK IPC br1 GOV is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.